All Categories

Featured

Table of Contents

- – Facts About Best Life Insurance With No Medica...

- – Getting My 3 Best No-exam Life Insurance Polic...

- – Life Insurance With No Medical Exam - Online ...

- – 4 Easy Facts About How To Get Instant Life In...

- – Getting The Finding No Medical Exam Term Lif...

- – Some Known Details About Best Life Insurance...

- – The Buzz on Can I Get Life Insurance Without...

[/image][=video]

[/video]

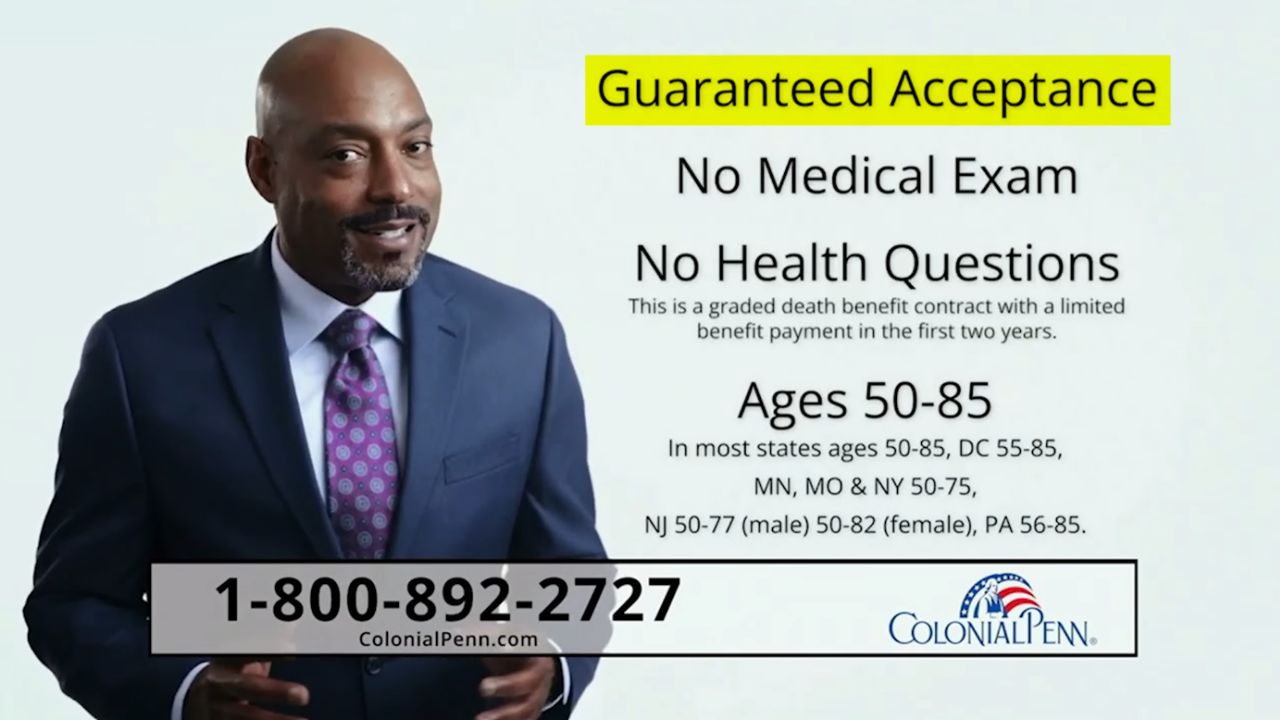

: If you have health problems that have actually caused life insurance providers to deny your applications, guaranteed issue life insurance policy can be a method to obtain coverage without bringing your health and wellness into inquiry in any way. You'll still need to meet age constraints, and your insurance coverage might be substantially much more pricey and limited.

Protection will be set at a percent of or 1-2 times your salary possibly not as limited as ensured issue life insurance policy coverage. Keep in mind that these policies might just remain energetic while you're still with the company and commonly just supply minimal insurance coverage amounts that you might wish to supplement with an additional plan.

It's challenging for an insurer to totally assess your lifestyle and health without health-related info. The higher threat they handle by supplying insurance coverage without the understanding of a wellness examination is offset by a higher costs. If you have a medical problem that you handle well, you might still get a common life insurance policy with a much more budget-friendly costs than the no-exam choices.

Facts About Best Life Insurance With No Medical Exam Revealed

A system of protection corresponds to the life insurance policy benefit amount you can purchase. It depends on age, gender (in Montana, age only) and state. Please get a quote to see benefit amounts and costs available to you for up to 25 devices of protection. You don't need to respond to any kind of inquiries regarding your wellness or take a physical examination.

Your coverage can remain in pressure as long as you pay your premiums when due. If your coverage is in force and has a cash money worth of course, you may get a loan on it.

Getting My 3 Best No-exam Life Insurance Policies In March 2025 To Work

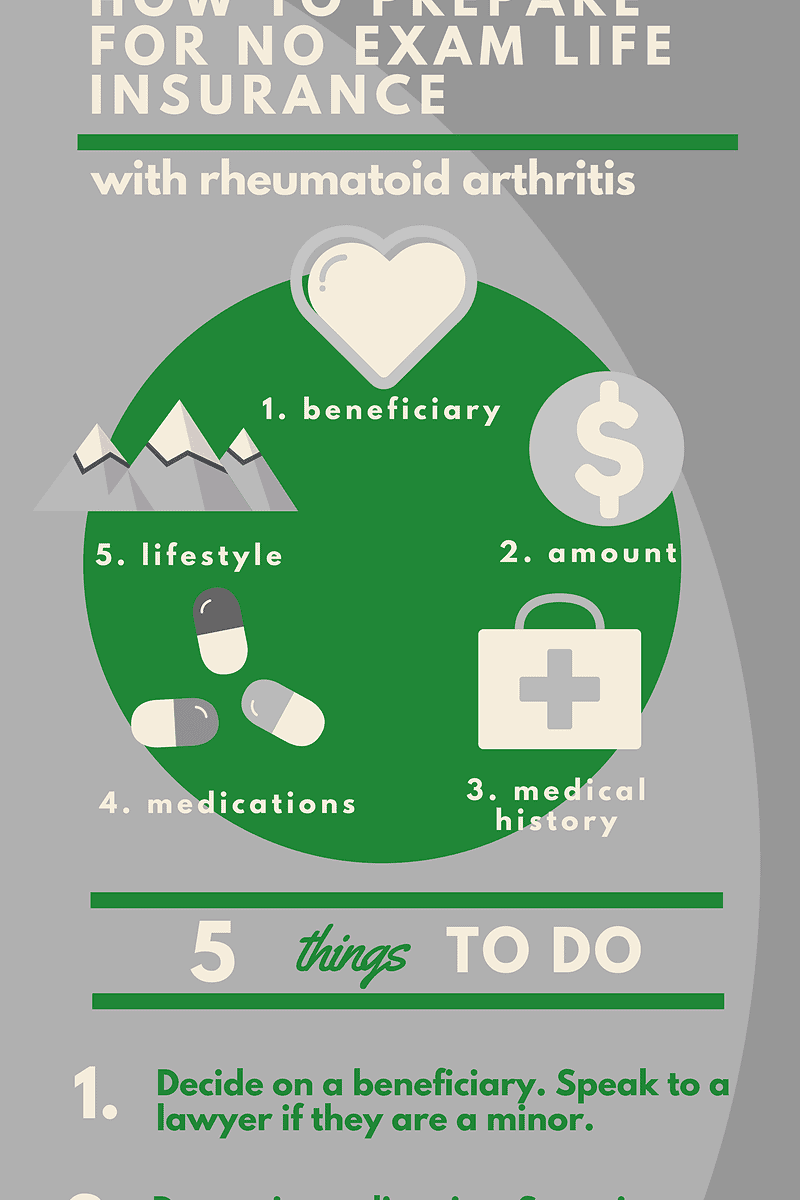

Life can be made complex, so when you locate a means to streamline the complex particularly for something as crucial as buying life insurance policy it's only all-natural to be curious. Lots of companies today use life insurance coverage without any medical examination as a fast and non-invasive way to obtain the defense you need.

As the name implies, no-exam life insurance policy can release a policy to you without requiring a medical examination, drastically minimizing what can in some cases be a lengthy ordeal, which can consist of lab job and a long application. Historically, life insurance policy carriers have needed a medical examination to aid offer the insurance business a far better image of your health and wellness.

It is planned for people who desire rapid protection, without a complicated underwriting procedure. While it might be a lot more expensive than plans via increased underwriting, it can be an appropriate option for people that have health and wellness issues or require immediate protection. Benefits: For simplified life insurance policy, there are usually fewer inquiries to answer, and fewer sources utilized to gather your information.

Benefits: With ensured problem life insurance, you're guaranteed insurance coverage, as the name recommends. There is no exam and there are no concerns to address, with age normally being the only restriction. Limitations: These policies use really limited coverage (normally regarding $25,000) and will certainly cost a lot more than conventional life insurance policy.

Given that streamlined concern plans collect less info than totally underwritten plans, prices has a tendency to be greater and has protection quantities $1 million or lower. An ensured problem plan might be the only choice for people that with certain clinical problems or insurance threats, so the greater rate may be worth the protection depending upon the need.

Obtain an on the internet quote or review your life insurance coverage requires today. Please note that this write-up is meant to inform and make clear several of the terms utilized by life insurance policy firms. Nationwide provides an accelerated underwriting procedure on Nationwide Life Essentials and Nationwide Ensured Degree Term. Nationwide offers a Simplified Whole Life product for existing Nationwide car and house owner's insurance participants.

Life Insurance With No Medical Exam - Online Quotes Can Be Fun For Anyone

Generally $100,000 $250,000. This protection can be Whole Life or Term. Streamlined concern plans do not need a medical exam, yet the candidate will need to address certain health concerns as part of the application procedure. Premiums for Simplified Problem policies will additionally be significantly higher than conventional policies. In addition to higher premiums, several Simplified Problem policies have a graded survivor benefit and only pay a claim if the insured dies 2 years after the problem date of the plan.

In the event where Accelerated Underwriting can not be completed, traditional underwriting with a medical examination would certainly be called for. Immediate Concern plans share the exact same rates as Typical plans. Qualification for no medical examination life insurance policy differs from firm to company and is based on the kind of no medical examination life insurance coverage plan desired.

Costs rates/costs of no medical examination life insurance policy plans vary by kind of plan, insurer and the insured's age. The less info an insurance provider finds out about you, the a lot more you will certainly pay due to the fact that the insurer is presuming even more risk. Surefire Problem plans will be the most cost, for the coverage amount bought, followed by Simplified Concern.

And, you will have access to the results of your clinical examination, so think about it as a complimentary physical. At McFie Insurance coverage, we concentrate on designing the most effective life insurance policy policies for you. After assessing your monetary situation, we'll assist you locate the strategy and insurance coverage quantity that will be best for you, to make sure that you can have comfort.

There are lots of methods to accessibility information regarding finances, yet it can be hard to figure out which resources are trustworthy. I such as to place info together in a precise, straightforward, very easy to recognize fashion so people can make great economic decisions based upon the information provided without having to lose time wondering if the source is dependable.

4 Easy Facts About How To Get Instant Life Insurance Online Explained

Get the protection your household requires, with no wellness inquiries and no medical examination. With Assured Issue Life, you can remain insured for life.

Benefits will not be paid if fatality results from self-destruction or, directly or indirectly, from a pre-existing condition within two years of the efficient date of the plan. In the case of self-destruction, we will certainly return all premiums paid without any passion modification.

Getting The Finding No Medical Exam Term Life Insurance In 2025 To Work

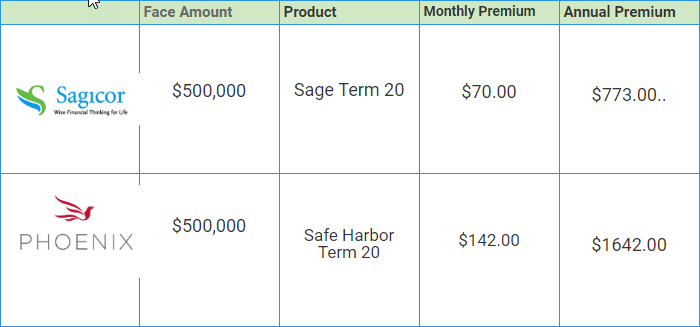

We don't obtain paid for our evaluations. The typical term life insurance policy prices in the graph above are from Corebridge Financial, Haven Life, Legal & General America, Lincoln, Mutual of Omaha, Pacific Life, and Safety. The no-exam term life insurance policy prices are from Everly, Foresters, and Lincoln. Our reviews and referrals can help you discover a trustworthy insurance company for your family members's economic defense, but the very best life insurance policy company for you depends upon several variables.

This protection can be Whole Life or Term. In enhancement to greater costs, numerous Simplified Issue plans have a rated death benefit and only pay an insurance claim if the insured passes away 2 years after the concern date of the policy.

In case where Accelerated Underwriting can not be completed, conventional underwriting with a clinical examination would be needed. Instantaneous Problem policies share the very same prices as Traditional policies. Eligibility for no clinical examination life insurance differs from business to business and is based upon the type of no medical exam life insurance policy policy desired.

Costs rates/costs of no medical exam life insurance policies differ by sort of policy, insurer and the insured's age. The much less info an insurance policy company finds out about you, the a lot more you will certainly pay due to the fact that the insurance coverage company is assuming more danger. Surefire Problem plans will certainly be one of the most cost, for the protection amount acquired, followed by Simplified Problem.

Some Known Details About Best Life Insurance For Seniors Without Medical Exams In ...

And, you will certainly have accessibility to the results of your medical examination, so assume of it as a cost-free physical. At McFie Insurance, we focus on making the very best life insurance plans for you. After examining your financial circumstance, we'll aid you discover the plan and protection quantity that will be best for you, to make sure that you can have satisfaction.

There are several means to gain access to info regarding funds, however it can be tough to figure out which resources are credible. I such as to put details with each other in an accurate, simple, understandable way so people can make good financial choices based upon the information offered without needing to lose time asking yourself if the resource is reputable.

Get the defense your family members needs, with no health inquiries and no medical exam. With Ensured Concern Life, you can stay guaranteed for life. Your coverage will never ever reduce, and your costs will certainly never boost. You can save substantially on your costs if you do not smoke. This is not an agreement.

The Buzz on Can I Get Life Insurance Without A Medical Exam?

Benefits will not be paid if death results from self-destruction or, straight or indirectly, from a pre-existing problem within two years of the effective date of the plan. In the situation of suicide, we will return all costs paid without any kind of passion change.

The typical term life insurance policy rates in the graph above are from Corebridge Financial, Sanctuary Life, Legal & General America, Lincoln, Mutual of Omaha, Pacific Life, and Protective. The no-exam term life insurance coverage rates are from Everly, Foresters, and Lincoln.

Table of Contents

- – Facts About Best Life Insurance With No Medica...

- – Getting My 3 Best No-exam Life Insurance Polic...

- – Life Insurance With No Medical Exam - Online ...

- – 4 Easy Facts About How To Get Instant Life In...

- – Getting The Finding No Medical Exam Term Lif...

- – Some Known Details About Best Life Insurance...

- – The Buzz on Can I Get Life Insurance Without...

Latest Posts

The Ultimate Guide To The Best No Medical Exam Life Insurance Companies For ...

Find Out If Instant Life Insurance Is A Fit For You Fundamentals Explained

The Facts About Myths About Life Insurance With No Medical Exam Uncovered

More

Latest Posts

The Ultimate Guide To The Best No Medical Exam Life Insurance Companies For ...

Find Out If Instant Life Insurance Is A Fit For You Fundamentals Explained

The Facts About Myths About Life Insurance With No Medical Exam Uncovered